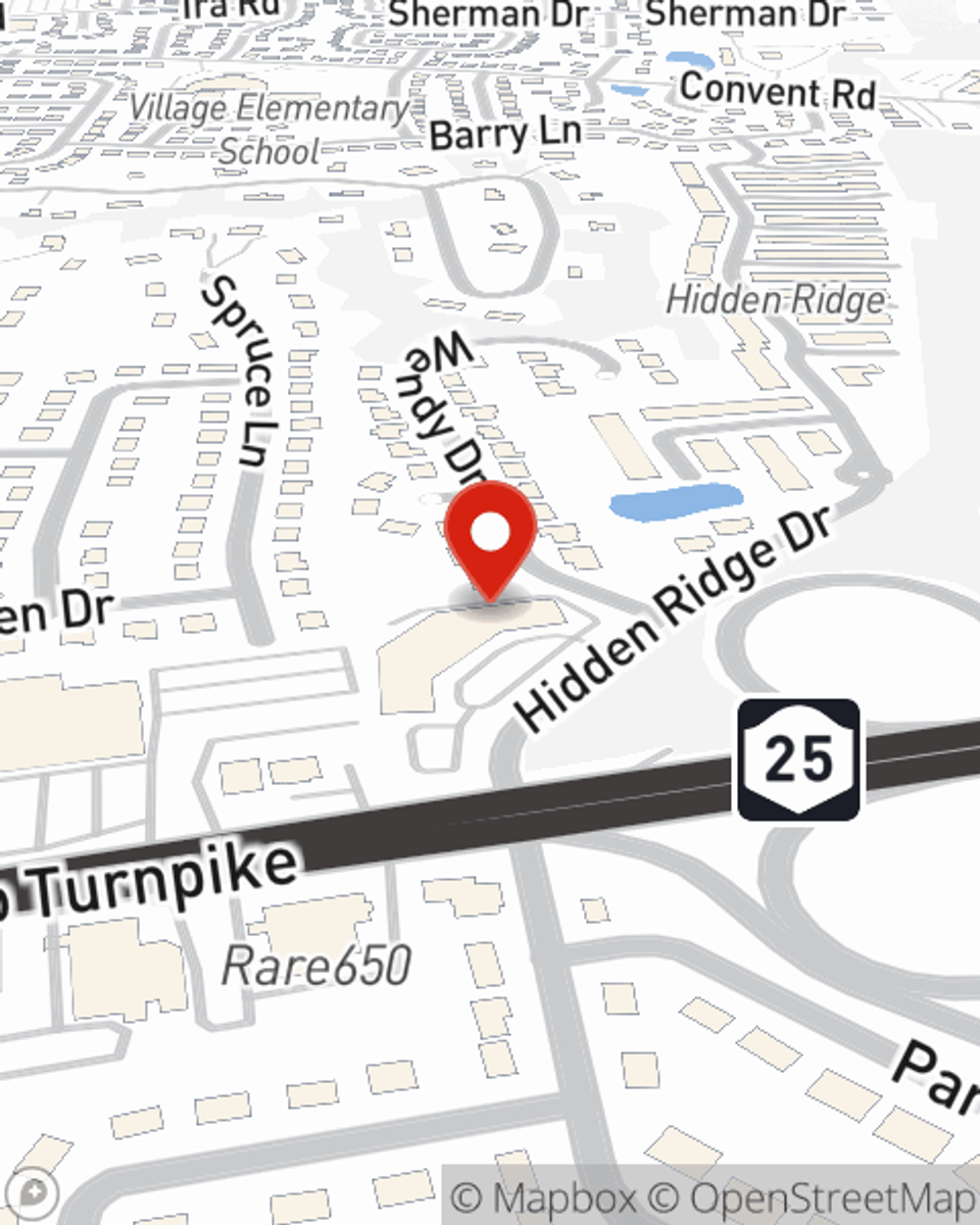

Life Insurance in and around Syosset

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Cold Spring Harbor

- South Huntington

- Huntington

- Dix Hills

- Mill Neck

- Oyster Bay

- Sea Cliff

- Glen Cove

- Glen Head

- East Norwich

- Greenvale

- Woodbury

- Syosset

- Jericho

- Old Westbury

- Old Bethpage

- Bethpage

State Farm Offers Life Insurance Options, Too

When you're young and a recent college graduate, you may think you don't need Life insurance. But it's a good time to start looking into Life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Why Syosset Chooses State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years level or flexible payments with coverage to last a lifetime or another coverage option, State Farm agent Marcela Ruppert can help you with a policy that's right for you.

If you're a person, life insurance is for you. Agent Marcela Ruppert would love to help you learn more about the variety of coverage options that State Farm offers and help you get a policy that's right for you and your loved ones. Call or email Marcela Ruppert's office to get started.

Have More Questions About Life Insurance?

Call Marcela at (516) 922-1976 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Marcela Ruppert

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.